Will Insurance Cover My Breast Reduction? A Complete Guide

Learn exactly what insurance companies require for breast reduction coverage, including the Schnur Scale criteria, BMI requirements, and how to navigate the pre-authorization process.

Breast reduction surgery is a life-changing procedure for most patients. Beyond the cosmetic improvement of smaller, more proportionate breasts, many women experience lasting relief from chronic neck pain, back pain, shoulder issues, and headaches. Even modest reductions can provide symptom improvement by changing your body's center of gravity when the breast tissue is repositioned higher on the chest.

The good news? Many insurance plans do cover breast reduction—but getting approval requires meeting specific criteria. This comprehensive guide walks you through exactly what you need to know.

First: Check If Reduction Is a Covered Benefit

Before anything else, verify that breast reduction is a covered benefit under your specific plan. Most insurance plans include coverage, but unfortunately, some plans exclude breast reduction under any circumstance.

How to check: - Call the member services number on your insurance card - Ask specifically: "Is breast reduction (CPT code 19318) a covered benefit?" - Request written documentation if possible

If your plan doesn't cover breast reduction at all, you'll need to either appeal, change plans during open enrollment, or consider self-pay options.

The Four Boxes You Need to Check

Assuming breast reduction is a covered benefit, you'll typically need to meet four criteria. Think of these as boxes to check on your path to approval.

Box 1: Conservative Measures

Insurance companies require documentation that you've tried "conservative" (non-surgical) treatments first. These typically include:

- Properly fitted, supportive bras

- Regular exercise and stretching

- Over-the-counter pain medications

- Physical therapy (in some cases)

The reality: Most women with symptomatic large breasts have already tried all of these measures without lasting relief. Your surgeon will document this during your consultation. While there's limited medical evidence that these measures provide significant improvement for large-breasted women, it remains an insurance requirement.

Box 2: Meeting Schnur Scale Criteria

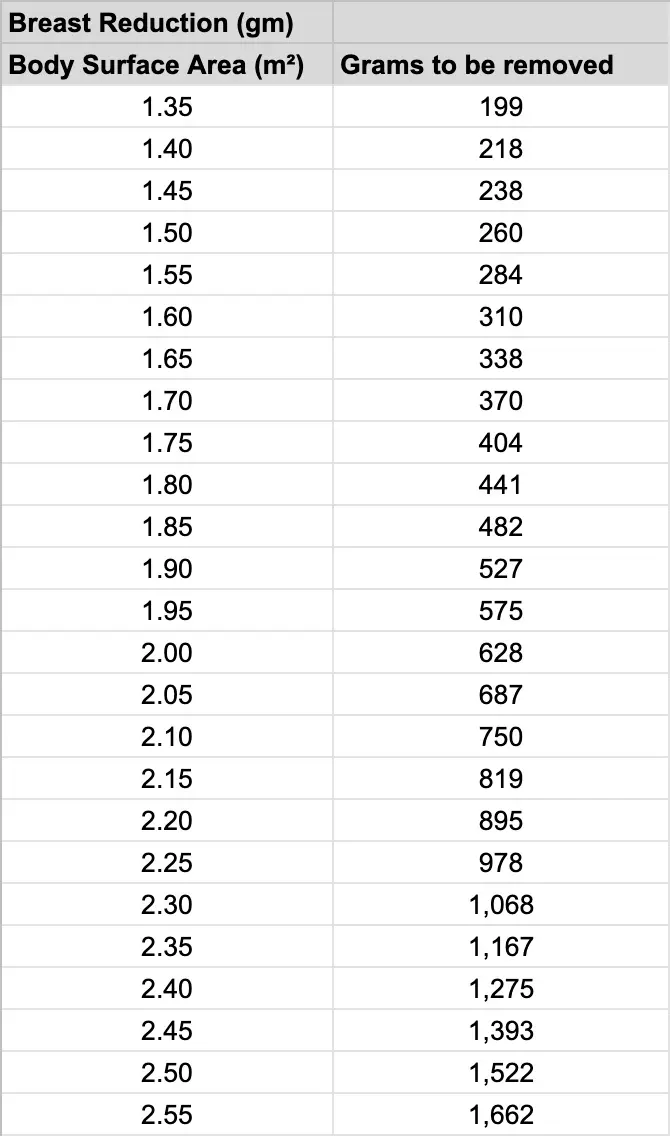

The Schnur Scale is the most critical factor in insurance approval. This sliding scale determines the minimum amount of breast tissue that must be removed based on your body surface area (BSA).

Understanding Body Surface Area

Your BSA is calculated using your height and weight through a standard medical formula. You can calculate yours using a body surface area calculator.

The Schnur Sliding Scale

General rule: Most patients need approximately 500 grams (about 1 pound) removed from each breast. For reference, a standard soda can weighs about 355 grams.

Important: If you cannot meet the Schnur criteria for your BSA, your procedure will not be covered—regardless of how severe your symptoms are. This is a frustrating reality that many plastic surgeons, including Dr. Schnur himself, disagree with, but it remains the standard insurance companies use.

Box 3: BMI Requirements

Many insurance plans have Body Mass Index (BMI) requirements:

- Some plans require BMI under 35

- Some plans require BMI under 30

- Others have no BMI requirement

BMI requirements exist partly for surgical safety reasons, as higher BMI can increase complication risks. If you're close to the threshold, your surgeon may recommend weight management before pursuing authorization.

Note: This is not about appearance—it's about optimizing surgical safety and outcomes.

Box 4: Prior Medical Documentation

Some insurance plans require:

- Documentation of treatment by a physician other than your plastic surgeon

- Records of physical therapy visits

- A specific time period of documented symptoms

If you have existing records, bring them to your consultation. Documentation from: - Your primary care physician - Physical therapist - Chiropractor - Pain management specialist

...can all support your case for medical necessity.

The Pre-Authorization Process

Once you've met with your plastic surgeon and they determine you're a candidate, their office will submit a pre-authorization request to your insurance company.

What happens: 1. Your surgeon's office prepares documentation 2. They submit clinical notes, photos, and medical necessity justification 3. Insurance reviews the request 4. You receive approval or denial (typically 2 days to 2 weeks)

If Approved

Congratulations! But understand that "approved" doesn't mean "free." You'll still be responsible for:

- Annual deductible

- Co-insurance percentage

- Co-pays

- Any out-of-pocket maximum not yet met

Get a cost estimate from your surgeon's office and insurance company before scheduling surgery so you're not surprised.

If Denied

Don't panic—denials can often be appealed. Your surgeon's office can:

- Request a peer-to-peer review

- Submit additional documentation

- File a formal appeal

Many initially denied cases are approved on appeal with additional information.

Liposuction-Only Reduction: Not Covered

It's important to note that liposuction breast reduction is not covered by any insurance plans at this time. If you're a candidate for liposuction-only reduction (typically women with smaller, less droopy breasts composed primarily of fatty tissue), this would be a self-pay procedure.

Tips for Success

Before your consultation: - Gather any existing medical records relating to symptoms - Note how long you've experienced symptoms - List all conservative treatments you've tried - Know your insurance plan details

During your consultation: - Be thorough about your symptoms and their impact - Bring documentation of prior treatments - Ask about your estimated Schnur criteria numbers - Discuss realistic expectations

After submission: - Follow up if you haven't heard back in 2 weeks - Respond promptly to any insurance requests for information - Keep copies of all correspondence

The Bottom Line

While the insurance approval process can seem overwhelming, experienced plastic surgeons navigate it regularly and can guide you through with minimal stress. The key is understanding the requirements upfront, gathering appropriate documentation, and working with a surgeon's office experienced in insurance pre-authorizations.

Most women who meet the criteria do receive approval. And for those who don't quite meet insurance requirements, self-pay options with financing can make breast reduction accessible.

The relief and improved quality of life that breast reduction provides makes the effort to obtain coverage well worthwhile.

Ready to Take the Next Step?

Our team is here to answer your questions and help you begin your journey.